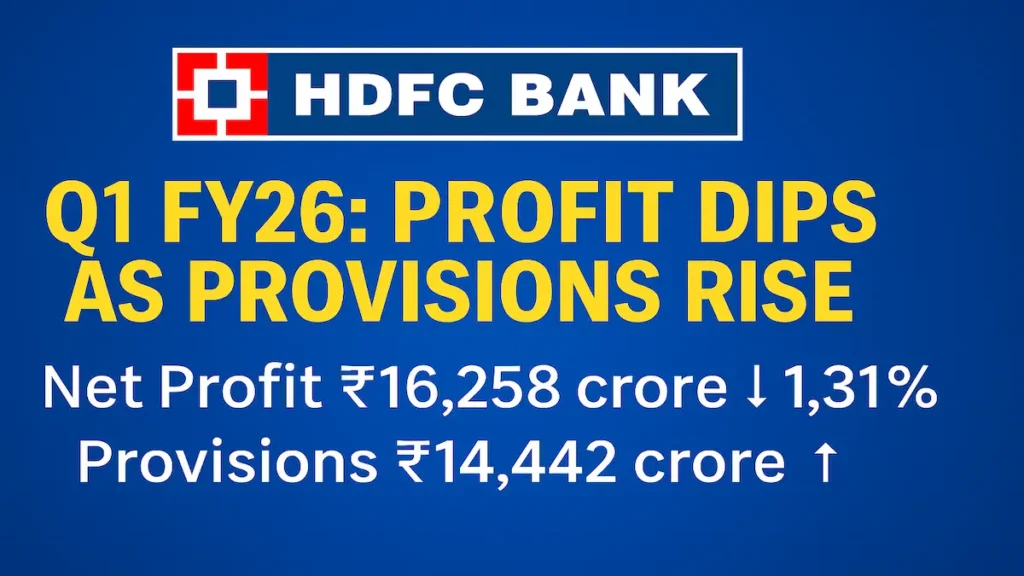

HDFC Bank’s Q1 numbers are out, and they tell two stories. On one side, the bank earned more from lending and fee-based services. On the other, it set aside a big chunk of money to deal with potential future risks. That hit the overall profit.

The bank’s consolidated net profit dropped slightly—down 1.31% YoY to ₹16,258 crore. That’s a small fall, but it comes after heavy provisioning. The big number here? ₹14,442 crore in total provisions.

Even with that dip, the bank’s core operations looked solid. On a standalone basis, profit went up by 12.2% YoY to ₹18,155 crore. That’s strong growth, especially considering the pressure banks face in today’s environment.

Let’s break it down.

The bank pulled in ₹31,438 crore in Net Interest Income, up 5.4% from last year. Loans are growing. Customers are borrowing. Business is moving.

But there’s a catch. Margins are shrinking. The Net Interest Margin (NIM) came down to 3.35%, from 3.46%. That’s not a disaster, but it’s something investors will watch closely. Margins are where banks make money. Even a small dip matters.

Fee-based income and gains from treasury also gave a boost. So while lending was a bit less profitable, other areas helped make up for it.

Also Read: Reliance Power Turns Profitable in Q1 with ₹45 Cr Net Profit

This is where things get serious.

HDFC Bank made a bold move. It put away ₹14,442 crore as provisions. That’s a huge jump from the ₹2,602 crore it set aside during the same period last year.

Out of this, ₹9,000 crore was labeled as “floating provisions.” Basically, money kept for emergencies—just in case.

Another ₹1,700 crore went into what’s called “contingent provisioning.” That’s more of a safety cushion, not tied to any specific problem right now, but meant for uncertainty ahead.

That’s a smart move in an economy that’s still adjusting post-merger and with global risks in the background. But it does bite into short-term profit.

HDFC Bank made ₹9,128 crore in pre-tax profit by selling a part of its stake in HDB Financial Services during its IPO. That helped balance the profit books. Without that, the dip might have been deeper.

So while provisions pulled profit down, the HDB IPO helped soften the blow.

The bank’s lending book stayed healthy. Total loans grew 6.7% YoY, hitting ₹26.53 lakh crore. Deposits also moved up, growing 16.2% to ₹27.64 lakh crore.

But the CASA ratio—which tracks how much money customers keep in low-interest accounts—fell to 33.9%. A year ago, it was 38.2%. That’s a sharp drop.

More people are moving money into fixed deposits. That costs the bank more and puts pressure on margins.

No red flags on bad loans.

- Gross NPA: 1.40%

- Net NPA: 0.47%

These numbers are stable. No major spike in bad loans. That’s good news.

The board announced a 1:1 bonus share issue. So if you hold one share, you’ll get one more. That’s big.

Also, shareholders get a ₹5 per share interim dividend. A nice reward, especially during a quarter with a slight profit dip.

This wasn’t a blowout quarter, but it wasn’t weak either. The bank is playing it safe. Earning well. Preparing for the unknown. Giving shareholders a bonus and dividend while building a giant safety net.

Margins and CASA need watching. But the loan growth, fee income, and stable asset quality show the bank’s engine is still running strong.

HDFC Bank isn’t taking chances. It’s preparing for whatever comes next.

Recent Posts

MOBILISE APP LAB LTD. Fact Sheet, MOBILISE APP LAB LTD. Financial Results - Equitymaster

Kwality Wall's (India) Limited Schedules Board Meeting for March 6, 2026 to Approve Q3FY26 Financial Results - scanx.trade

NBCC (India) Limited (NSE:NBCC) Third-Quarter Results: Here's What Analysts Are Forecasting For Next Year - simplywall.st

Agro Phos India Ltd Reports Mixed Quarterly Results Amid Financial Trend Shift - Markets Mojo

Important Bank Holiday Trading Hours Update – January & February 2026

NIFTY50 and SENSEX open 0.6% higher after India-US trade deal; SBI top gainer after strong quarterly results - Upstox

Tata Power-DDL launches Solar Sakhi Abhiyan

Next-Gen GST Reform: A Historic Diwali Gift for the Nation

Angel One Stock Broker Review

Income Tax Alert: ITR Filing Last Date for FY 2024-25 (AY 2025-26)

TikTok in India: The Buzz, the Ban, and What’s Really Happening

Wordle Answer Today (August 20, 2025): Hints and Full Solution Explained