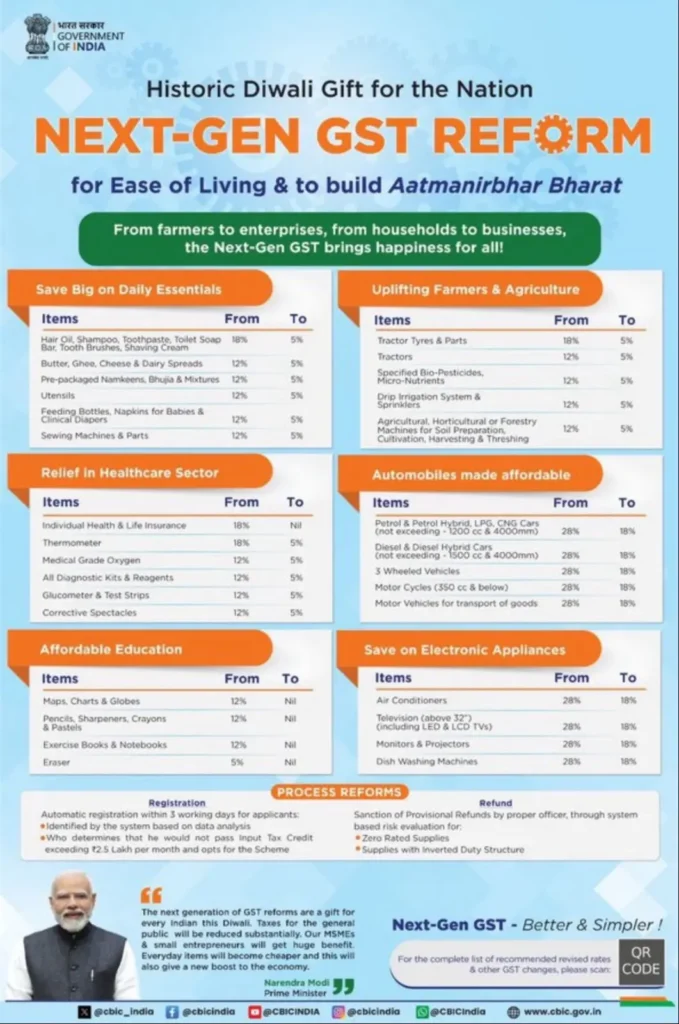

The Government of India has announced a new Goods and Services Tax (GST) reform ahead of Diwali. The reform has been described as a historic step to bring ease of living and to strengthen the vision of Aatmanirbhar Bharat. The government has reduced GST rates on many essential products, education items, healthcare goods, farm equipment, automobiles, and electronic appliances. The new rules are being called the Next-Gen GST Reform.

The objective of this reform is simple. People will spend less on daily goods. Farmers and students will get direct benefits. Healthcare will become affordable. Businesses, especially MSMEs and small traders, will see more growth. Everyday savings for households will also add to overall economic activity.

Cheaper Daily Essentials

The new GST rate cuts will directly reduce household budgets. Items like hair oil, shampoo, toothpaste, toilet soap, toothbrushes, and shaving cream will now attract only 5 percent GST instead of 18 percent. Dairy items like butter, ghee, cheese, and spreads will now come under 5 percent instead of 12 percent.

Pre-packaged namkeens, bhujia, and mixtures will now attract 5 percent GST. Utensils, feeding bottles, baby napkins, and clinical diapers have also shifted to 5 percent. Even sewing machines and parts have been brought down from 12 percent to 5 percent.

This move is expected to make daily life more affordable for millions of households.

Benefits for Farmers and Agriculture

Farmers have received special attention in this reform. Tractor tyres and parts which earlier attracted 18 percent GST will now be taxed at only 5 percent. Tractors, bio-pesticides, micro-nutrients, drip irrigation systems, and sprinklers will also come under 5 percent GST instead of 12 percent.

Agricultural, horticultural, and forestry machines used for soil preparation, cultivation, harvesting, and threshing will also now fall under 5 percent. This reduction will help reduce the input cost for farmers and encourage modern equipment usage in agriculture.

Relief for Healthcare Sector

The GST reform provides big relief in healthcare. Individual health and life insurance will no longer carry GST. The rate has been reduced from 18 percent to zero. Medical items like thermometers, oxygen cylinders, diagnostic kits, glucometers, and test strips have been reduced to 5 percent GST. Corrective spectacles also now fall under 5 percent.

This move will lower the burden of healthcare costs on families and support the medical sector in India.

Affordable Education

Education has been given special focus. GST on maps, charts, and globes has been reduced from 12 percent to zero. Pencils, sharpeners, crayons, and pastels have also been exempted. Exercise books, notebooks, and erasers will now be tax-free as well.

By removing GST on basic education supplies, the government is trying to make learning affordable and accessible to every student.

Automobiles Become Affordable

The GST cut also extends to the automobile sector. Petrol and petrol hybrid cars, LPG cars, and CNG cars up to 1200cc engine capacity and 4000mm length will now attract 18 percent GST instead of 28 percent. Diesel and diesel hybrid cars up to 1500cc engine capacity and 4000mm length will also move to 18 percent.

Three-wheeled vehicles, motorcycles up to 350cc, and vehicles used for transport of goods will all now fall under 18 percent GST instead of 28 percent. This reduction will make mobility more affordable and may encourage higher sales in the automobile sector.

Lower Prices for Electronic Appliances

Electronic appliances have also received a price cut. Air conditioners, televisions above 32 inches including LED and LCD models, monitors, projectors, and dishwashing machines will now attract 18 percent GST instead of 28 percent.

This move will help households upgrade their appliances at lower costs and support growth in consumer demand.

Process Reforms

Along with rate cuts, the reform introduces simpler processes. Applicants will now get automatic GST registration within three working days. Refunds will be sanctioned quickly through system-based evaluation. This includes refunds for zero-rated supplies and inverted duty structures.

The simplified process will reduce compliance pressure for small businesses and entrepreneurs.

Government’s Statement

Prime Minister Narendra Modi has described this reform as a gift for every Indian during Diwali. He said that taxes for the general public will reduce substantially. MSMEs and small entrepreneurs will benefit. Everyday items will become cheaper, and the economy will get a new boost.

The Next-Gen GST Reform is one of the biggest tax changes in recent years. It reduces GST rates on essential goods, education, healthcare, agriculture, automobiles, and electronics. It also introduces easier registration and refund processes.

For households, the change means direct savings. For farmers, it lowers input costs. For students, education materials are now more affordable. For healthcare, essential products will be cheaper. For businesses, the system becomes more supportive.

Overall, this reform is expected to improve the cost of living for families, give relief to farmers and patients, and promote growth in industries. It is truly being seen as a Diwali gift for the nation.

Next-Gen GST Reform: Old vs New Rates

| Category | Items | Old GST Rate | New GST Rate |

|---|---|---|---|

| Daily Essentials | Hair oil, shampoo, toothpaste, toilet soap bar, toothbrushes, shaving cream | 18% | 5% |

| Butter, ghee, cheese, dairy spreads | 12% | 5% | |

| Pre-packaged namkeens, bhujia, mixtures | 12% | 5% | |

| Utensils | 12% | 5% | |

| Feeding bottles, baby napkins, clinical diapers | 12% | 5% | |

| Sewing machines & parts | 12% | 5% | |

| Agriculture | Tractor tyres & parts | 18% | 5% |

| Tractors | 12% | 5% | |

| Specified bio-pesticides, micro-nutrients | 12% | 5% | |

| Drip irrigation system & sprinklers | 12% | 5% | |

| Agricultural/forestry machines for soil preparation, harvesting, threshing | 12% | 5% | |

| Healthcare | Health & life insurance | 18% | Nil |

| Thermometer | 18% | 5% | |

| Medical grade oxygen | 12% | 5% | |

| Diagnostic kits & reagents | 12% | 5% | |

| Glucometer & test strips | 12% | 5% | |

| Corrective spectacles | 12% | 5% | |

| Education | Maps, charts, globes | 12% | Nil |

| Pencils, sharpeners, crayons, pastels | 12% | Nil | |

| Exercise books & notebooks | 12% | Nil | |

| Erasers | 5% | Nil | |

| Automobiles | Petrol, hybrid, LPG, CNG cars (≤1200cc & 4000mm) | 28% | 18% |

| Diesel, hybrid cars (≤1500cc & 4000mm) | 28% | 18% | |

| Three-wheeled vehicles | 28% | 18% | |

| Motorcycles (≤350cc) | 28% | 18% | |

| Motor vehicles for goods transport | 28% | 18% | |

| Electronics | Air conditioners | 28% | 18% |

| Televisions above 32” (including LED & LCD) | 28% | 18% | |

| Monitors & projectors | 28% | 18% | |

| Dishwashing machines | 28% | 18% |

For Advertising, Guest Posting, Newsletter Inserts please contact [email protected]. For general enquiries contact [email protected].

Recent Posts

Important Bank Holiday Trading Hours Update – January & February 2026

Tata Power-DDL launches Solar Sakhi Abhiyan

Next-Gen GST Reform: A Historic Diwali Gift for the Nation

Angel One Stock Broker Review

Income Tax Alert: ITR Filing Last Date for FY 2024-25 (AY 2025-26)

TikTok in India: The Buzz, the Ban, and What’s Really Happening

Wordle Answer Today (August 20, 2025): Hints and Full Solution Explained

Google Expands Store in India and Faces Global Play Store Challenges

Ola Electric Shares Recover Strongly After Heavy Fall in 2025

Gold Price Today: Rates Fall as Strong Dollar Impacts Market

Shreeji Shipping Global IPO Sees Strong Demand, GMP Suggests Listing Gains

India Approves ₹62,000 Crore Deal for LCA Tejas Mark 1A, HAL Shares Gain