Two new public issues, Mangal Electrical Industries and Gem Aromatics, are currently active in the primary market. Both companies have come with sizeable initial public offerings (IPOs) in August 2025. Investors are closely watching their subscription numbers and grey market premium (GMP). Let us look at the key details of these IPOs.Mangal Electrical Industries IPO

Mangal Electrical Industries opened its IPO on August 20, 2025. The issue will close on August 22, 2025. The company aims to raise nearly ₹400 crore through this offering. The price band has been fixed between ₹533 and ₹561 per share.

This is a fresh issue of equity shares. The funds will be used for different business needs. The company plans to repay loans worth ₹101.3 crore. It will also invest around ₹87.9 crore to expand its Rajasthan facility. A further ₹122 crore will be used to meet working capital requirements. The remaining money will be spent on general corporate purposes.

Before the IPO launch, the company raised ₹120 crore from anchor investors. The anchor investors bought shares at the upper price of ₹561 per share. This has built early confidence in the issue.

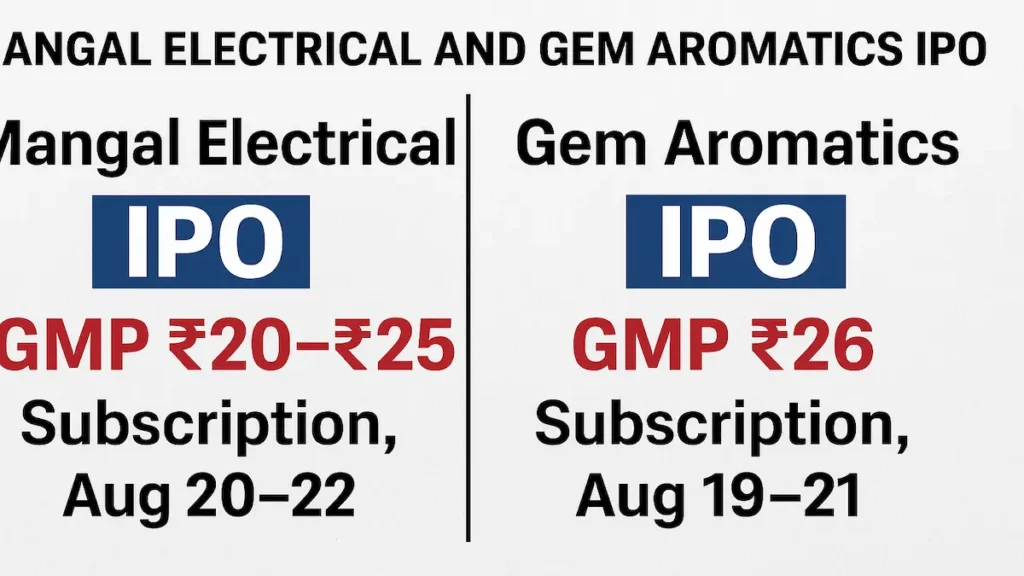

In the grey market, Mangal Electrical shares are trading with a premium of ₹20–₹25. This means a gain of around 4 to 4.5 percent over the issue price. While the premium is modest, it still shows positive investor sentiment.

The basis of allotment is likely to be finalised by August 25. Shares are expected to list on the exchanges around August 27 or August 28.

Brokerages such as Anand Rathi, Ventura, and Canara Bank Securities have given positive reviews. They suggest applying for the IPO with a long-term view. Analysts believe the company is well-placed to benefit from the growth in the power and infrastructure sector. However, they also warn about risks such as dependence on imports and high customer concentration.Gem Aromatics IPO

Gem Aromatics launched its IPO on August 19, 2025. The issue will close on August 21, 2025. The company has fixed a price band of ₹309 to ₹325 per share. The IPO size is about ₹451 crore, which includes both a fresh issue and an offer for sale.

On the first day itself, the IPO was fully subscribed. By the end of Day 1, the overall subscription was 1.03 times. Retail investors subscribed their portion 1.08 times, while Qualified Institutional Buyers (QIBs) subscribed 1.05 times. Non-institutional investors (NIIs) showed lower participation with 89 percent subscription.

In the grey market, Gem Aromatics is showing a stronger trend. The GMP is around ₹26 per share, which is an 8 percent premium over the issue price. This suggests a possible listing price near ₹351 per share.

The allotment date is expected on August 22, while the listing date is likely on August 26, 2025.

Gem Aromatics is a company engaged in the production of essential oils and aroma chemicals. It has more than 20 years of experience in this sector. In FY25, the company reported revenue of about ₹504 crore and a profit after tax (PAT) of ₹53 crore.

Brokerage houses like Swastika Investmart and Canara Bank Securities have given a positive outlook. They recommend the IPO for both long-term investment and short-term listing gains. At the same time, they note that valuations are on the higher side. There are also concerns over ongoing litigation involving one of the company’s key facilities.Final Outlook

Both IPOs have drawn interest from investors. Mangal Electrical Industries offers stability with modest GMP and strong anchor support. It is seen as a good bet for long-term investors who believe in the growth of India’s power sector.

On the other hand, Gem Aromatics has shown stronger early demand with higher subscription and GMP. It may provide better chances for listing gains. However, investors should keep in mind the higher valuations and risk factors before applying.

The primary market is seeing strong activity in August. These two IPOs are expected to add more excitement as investors wait for allotments and listing performance in the coming days.

Recent Posts

Important Bank Holiday Trading Hours Update – January & February 2026

Tata Power-DDL launches Solar Sakhi Abhiyan

Next-Gen GST Reform: A Historic Diwali Gift for the Nation

Angel One Stock Broker Review

Income Tax Alert: ITR Filing Last Date for FY 2024-25 (AY 2025-26)

TikTok in India: The Buzz, the Ban, and What’s Really Happening

Wordle Answer Today (August 20, 2025): Hints and Full Solution Explained

Google Expands Store in India and Faces Global Play Store Challenges

Ola Electric Shares Recover Strongly After Heavy Fall in 2025

Gold Price Today: Rates Fall as Strong Dollar Impacts Market

Shreeji Shipping Global IPO Sees Strong Demand, GMP Suggests Listing Gains

India Approves ₹62,000 Crore Deal for LCA Tejas Mark 1A, HAL Shares Gain