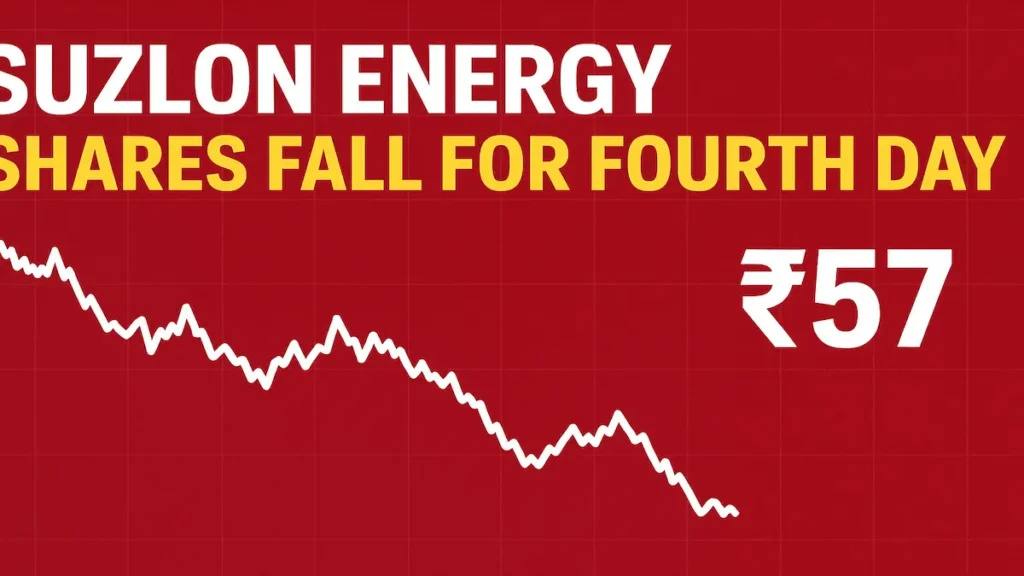

Suzlon Energy Limited, one of the leading renewable energy companies in India, is facing a difficult time in the stock market. The company’s shares continued to decline on Monday, August 18, 2025, marking the fourth straight day of losses. The stock dropped nearly 4–5 percent during the day, trading around ₹57–₹58 on both NSE and BSE.

Market experts say the fall in Suzlon shares comes after mixed quarterly results and a major leadership exit. The company recently announced its Q1 FY25-26 results, which showed strong revenue growth but only a small increase in net profit. Adding to this, the sudden resignation of the Chief Financial Officer (CFO) created doubts among investors.

Recent Stock Performance

Suzlon shares opened weak and remained under selling pressure. By afternoon, the stock was down about 4 percent to ₹57.62, while on BSE it slipped nearly 4.5 percent to ₹57.40. At one point, it even touched ₹56.85, becoming one of the top losers in the Nifty Midcap 150 index.

In just four trading sessions, Suzlon has lost almost 11 percent of its market value. Over the last 11 months, investors have seen an erosion of nearly ₹40,000 crore in market capitalization. The decline has disappointed many retail investors who had high hopes from the stock due to India’s push toward renewable energy.Quarterly Results

The company’s Q1 FY26 performance showed mixed signals. Revenue rose sharply by 55 percent year-on-year, highlighting strong demand in the wind energy sector. Consolidated net profit also increased, but only by 7 percent, reaching ₹324 crore.

While the growth in sales looked promising, the limited rise in profit worried analysts. Experts believe rising costs and narrow margins affected the bottom line. The resignation of the CFO added more pressure on the stock as it raised concerns about leadership stability.Financial Metrics

Suzlon’s financial ratios paint an interesting picture. The company’s 52-week high stands at ₹86.04, while the low is ₹46.15. The stock is now trading much closer to the lower side of this range.

- Market Capitalization: ₹78,000–₹82,000 crore

- Price-to-Earnings (PE) Ratio: Around 38–39×

- Price-to-Book (PB) Ratio: Around 13–14×

- Earnings Per Share (EPS): About ₹1.53

- Return on Equity (ROE): Around 33–41%

- Debt-to-Equity Ratio: Very low, around 0.05

These numbers show that Suzlon has low debt and strong returns on equity. However, the high PE and PB ratios suggest the stock is expensive compared to its earnings and book value.Outlook and Analyst View

Market analysts have mixed opinions about Suzlon’s future. Some believe the company has strong growth opportunities as India expands renewable energy capacity. Suzlon’s export potential also adds to its long-term prospects.

At the same time, the recent correction shows how sensitive the stock is to news and management changes. Analysts have given target prices in the range of ₹67 to ₹81, with an average target of around ₹76 for the next 12 months.

Recent Posts

MOBILISE APP LAB LTD. Fact Sheet, MOBILISE APP LAB LTD. Financial Results - Equitymaster

Kwality Wall's (India) Limited Schedules Board Meeting for March 6, 2026 to Approve Q3FY26 Financial Results - scanx.trade

NBCC (India) Limited (NSE:NBCC) Third-Quarter Results: Here's What Analysts Are Forecasting For Next Year - simplywall.st

Agro Phos India Ltd Reports Mixed Quarterly Results Amid Financial Trend Shift - Markets Mojo

Important Bank Holiday Trading Hours Update – January & February 2026

NIFTY50 and SENSEX open 0.6% higher after India-US trade deal; SBI top gainer after strong quarterly results - Upstox

Tata Power-DDL launches Solar Sakhi Abhiyan

Next-Gen GST Reform: A Historic Diwali Gift for the Nation

Angel One Stock Broker Review

Income Tax Alert: ITR Filing Last Date for FY 2024-25 (AY 2025-26)

TikTok in India: The Buzz, the Ban, and What’s Really Happening

Wordle Answer Today (August 20, 2025): Hints and Full Solution Explained